Investor-Focused

Real Estate financing

Hard money, DSC, fix & flip, rental, bridge, construction, and commercial loans designed to help real estate investors close faster and scale smarter, nationwide.

About Us

Helping Investors Fund Growth with Confidence

Investa Funding specializes in real estate investor financing across a wide range of property types and strategies. From hard money and fix & flip loans to long-term rentals, short-term rentals, multifamily (2–4 unit), ground-up construction, mixed-use commercial, and cash-out refinances, we provide flexible capital solutions built around how investors actually operate.

We understand that speed, structure, and certainty matter. Our streamlined process removes unnecessary friction, allowing investors to submit deal details, review financing options, and move toward funding without traditional bank delays. With an investor-first approach and a broad lending appetite, Investa Funding helps you execute deals, unlock equity, and scale your portfolio with confidence.

Apply Now!

Our Process

A Simple, Investor-Driven Funding Process

Our process is designed to move quickly from deal analysis to funding so you can focus on executing opportunities, not navigating red tape.

01

Consult

Review deal, goals, and financing strategy.

02

Application

Submit key details through a simple application.

03

Review

We analyze structure, risk, and exit plan.

04

Fund

Fast closing so you can execute.

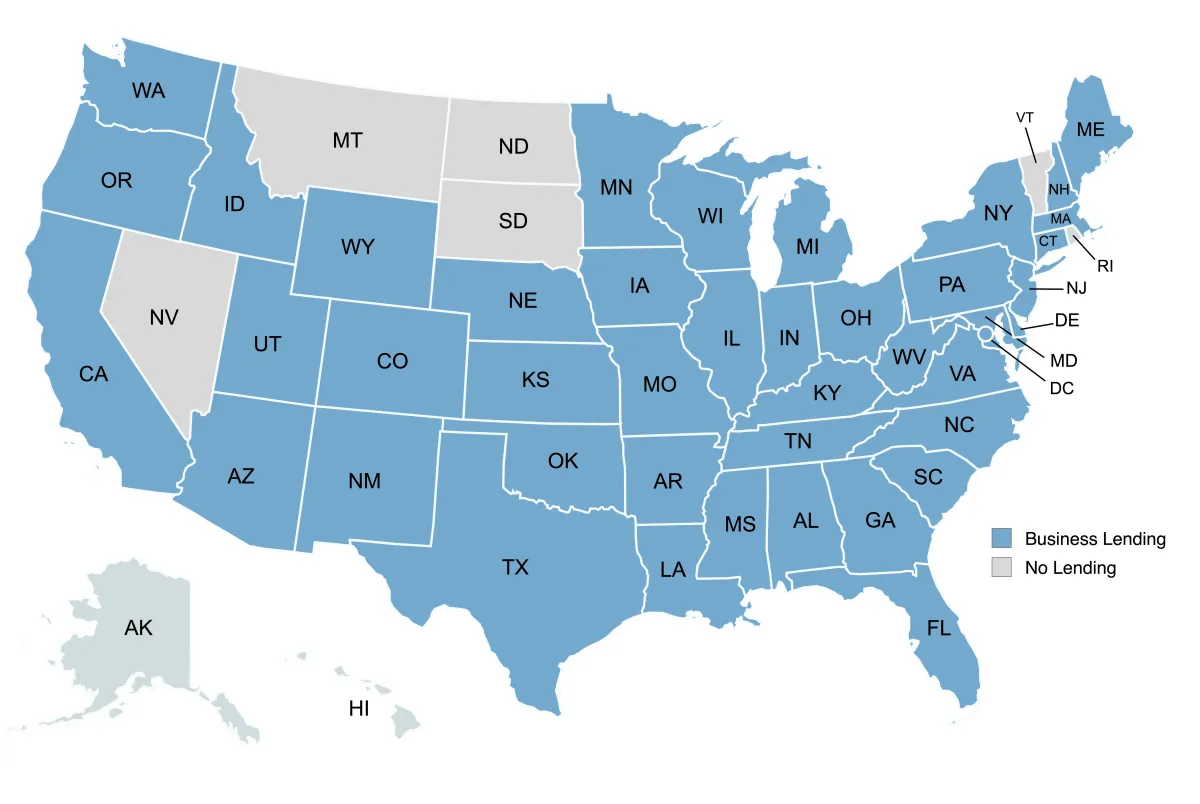

Where We Lend

States We Lend In

Looking for financing in a state not listed? We lend in additional states on a case-by-case basis. Contact us to discuss your deal and available options.